We’ve trawled through all the information for Budget 2018 and pulled out the best bits, that which is material in value and most relevant to you.

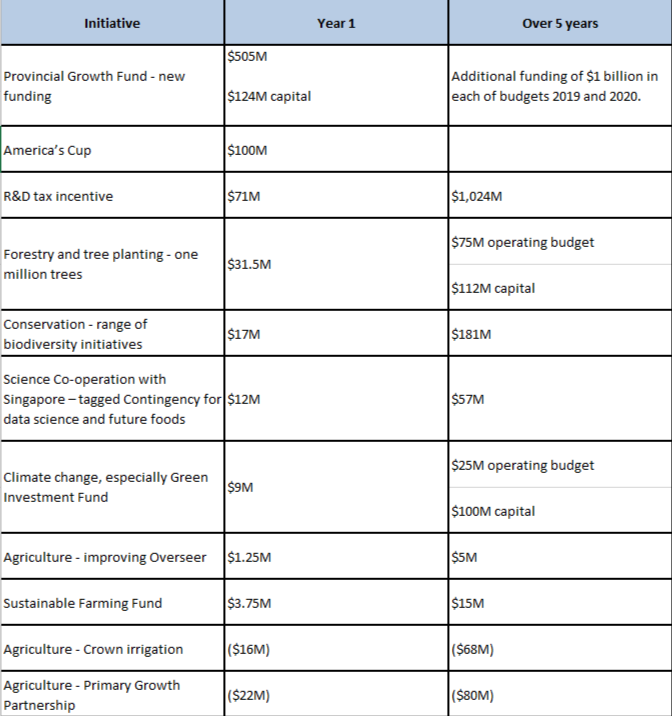

The Provincial Growth Fund easily tops the list, with $3 billion over three years. A one-off grant of $100 million to the America’s Cup and a Research & Development (R&D) tax incentive come in runner-up and third respectively.

There are a range of conservation initiatives and, very interestingly, a Green Investment Fund. The purpose of the Fund is to invest in assets that reduce carbon emissions, and do so in a manner that both mobilises additional private capital and allows the Fund to be commercially independent.

Agriculture loses any new investment in irrigation and the Primary Growth Partnership (PGP), but good to see that the workhorse Sustainable Farming Fund has a small increase.

The R&D tax incentive is a 12.5% non-refundable tax credit. It applies to businesses with an eligible R&D spend of over $100,000 per annum (up to a maximum of $120 million). The rule will apply to expenditure incurred from 1 April 2019.

This investment portfolio, in our opinion, lacks strategic clarity. It is not clear to us what outcomes the government is seeking from the above investment. Nonetheless, it does provide innovative and sustainable business good funding opportunities. We hope there is something in here for you. For more information on the tax credits and how to structure your R&D programme to be eligible, please contact us.